As bitcoin approaches 2022, an increasing number of long-term investors are doubling down on their holdings, thinking that the December drop was only a seasonal aberration.

Some industry experts see such long-term investments' underlying steadiness as potentially hopeful indicators for the volatile cryptocurrency.

According to digital currency brokerage Genesis Trading, the quantity of bitcoin stored in digital wallets with no withdrawals for more than five months has been continuously increasing since last July.

Furthermore, the amount of bitcoin stored in "illiquid" wallets - those that spend less than a quarter of their inflows - is increasing, implying that fewer coins are actively exchanged, according to the report, which used wallet data from numerous exchanges.

"The amount of bitcoins that haven't moved in over a year has been rising since July," said Noelle Acheson, Genesis Trading's head of market analysis. "That's mind-boggling."

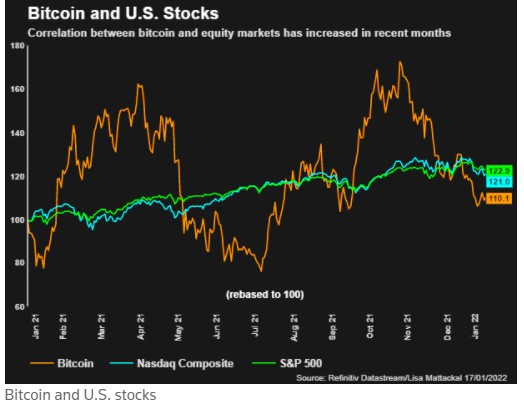

Many investors were sent running for cover in December, when the world's most popular cryptocurrency, bitcoin, fell over 20%, roughly the same as the second-largest coin, ether, as inflation fears and a faster pace of interest rate hikes from the US Federal Reserve dampened risk appetite.

While bitcoin and ether both gained ground last week, rising 2.9 percent to $43,107 and 6.3 percent to $3,350, respectively, they are still much behind their respective 2021 highs of $69,000 and $4,868.

Many cryptocurrency specialists warn that no one has ever been able to accurately predict bitcoin's notoriously volatile price movements. It increased from roughly $1,000 to around $20,000 in 2017. It briefly fell below $4,000 in early 2020 before surging to new heights.

However, proponents of bitcoin and other cryptocurrencies claim that the growing acceptance of cryptocurrencies in mainstream finance and investing has bolstered the sector in recent years.

Delphi Digital, a cryptocurrency research business, claimed their findings revealed a similar shift toward investors holding bitcoin for longer periods of time, which "illustrates a transition from shorter-term 'weak hands' to long-term strong hands'."

According to Will Hamilton, head of trading and research at Trovio Capital Management, the bitcoin Fear & Greed index has fluctuated between 10 and 29 since the beginning of the year, which might be an indicator of a likely market bottom and buying opportunities.

He went on to say that previous market bottoms in July 2021 and March 2020 were connected with Fear and Greed ratings of 19 and 10, respectively. Source